You've heard of home buying rebates, but what do they actually mean? And how can you use them? This article will address legality, common use, and guidelines for refinancing with home buying incentives. Plus, we will discuss the advantages and disadvantages this type of rebate. Keep reading for more information! All your questions will be answered in this article! Let's start by taking a look at what they do.

Legality

You might be curious about legality when it comes to home buying rebates. These incentives are becoming more popular over recent years. But there are some concerns. Many real estate professionals consider them biased promotion and recommend that you avoid them. While a buyer rebate doesn't increase your cost basis it might lower it and increase your capital gains tax exposure. If you are planning to use the rebate as a downpayment or reduce your cost basis, it is not legal.

Common uses

Homeowners who are eligible for a home-buying rebate can use the money for many purposes. The money can be used to pay closing costs. Others use it to offset the costs of moving, such as the price of new furniture. Some use the money to replace their home's appliances. And still others use it to make home improvements, such as new countertops and flooring. No matter your reason, there's a home-buying rebate that will suit you.

Refinance using a rebate

If you're looking to reduce the cost of your mortgage, consider refinancing home buying with a rebate. As a credit, you can receive 1% of the purchase amount as a rebate. Rebates may not be available in all states. AK, AL. IA. KS. LA. MO. OK. and OR are not eligible. Rates and terms are subject to change as well as rebate amounts.

Relocating guidelines

There are a few basic rules for claiming relocation services and relocating home buying rebates. Two appraisals should be within 5% of one another, although some clients will accept a spread of 7% to 10%. If both appraisals are out of range, a third appraisal is necessary. For the calculation of the GBO, two appraisals closest to the transferee are used.

Keep your prices competitive

You must remain competitive whether you are buying a property to live in or rent out. This is especially true in today's real estate market where there is very little inventory and fierce competition. Many buyers are finding it difficult to find homes that meet their needs. Here are some tips on how to remain competitive when buying property. Read on to learn more.

FAQ

How much does it cost for windows to be replaced?

Windows replacement can be as expensive as $1,500-$3,000 each. The cost of replacing all your windows will vary depending upon the size, style and manufacturer of windows.

What is a "reverse mortgage"?

Reverse mortgages are a way to borrow funds from your home, without having any equity. It allows you access to your home equity and allow you to live there while drawing down money. There are two types: conventional and government-insured (FHA). A conventional reverse mortgage requires that you repay the entire amount borrowed, plus an origination fee. FHA insurance covers your repayments.

What are the drawbacks of a fixed rate mortgage?

Fixed-rate mortgages tend to have higher initial costs than adjustable rate mortgages. Additionally, if you decide not to sell your home by the end of the term you could lose a substantial amount due to the difference between your sale price and the outstanding balance.

Statistics

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

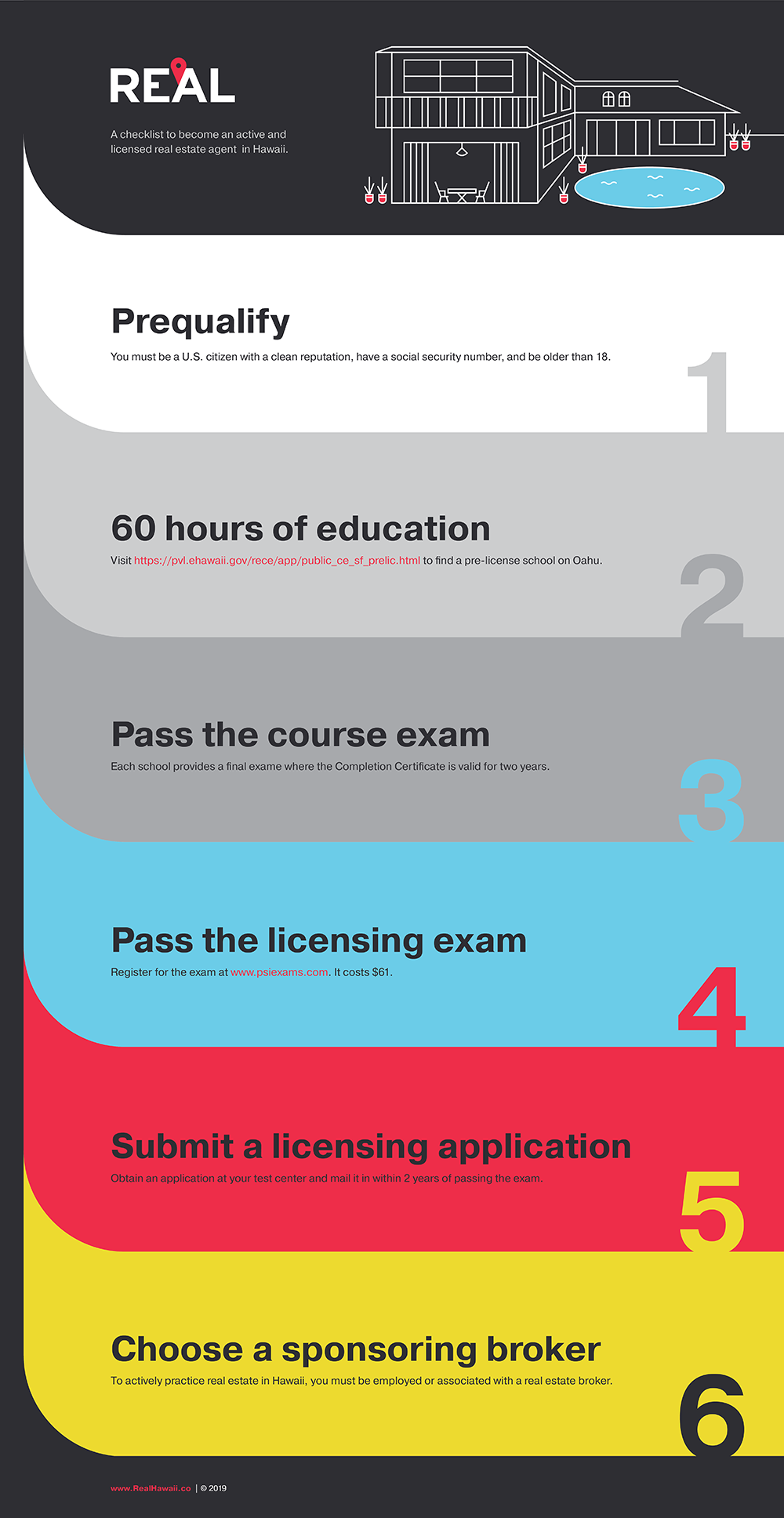

How to become real estate broker

The first step in becoming a real estate agent is to attend an introductory course where you learn everything there is to know about the industry.

Next, pass a qualifying test that will assess your knowledge of the subject. This means that you will need to study at least 2 hours per week for 3 months.

You are now ready to take your final exam. To be a licensed real estate agent, you must achieve a minimum score of 80%.

Once you have passed these tests, you are qualified to become a real estate agent.