It is subjective to answer the question "When does the seller get their money after closing?" Although there is no definitive answer, the average time it takes to get money after closing is between two and three days. This can vary greatly depending on a variety of factors. While you should expect to receive a cheque after closing, the actual amount of the check could vary. If you decide to get a check, you'll need to make sure you have sufficient funds available. You'll also need to ensure the check you receive is worth the time.

It is not necessarily bad to have a check. Actually, it can make the whole process smoother. It's also a good idea to consider using a real estate agent to help facilitate the process. A real estate agent can help find a buyer, get an offer made, and give information about the property. They can also help determine the right closing costs.

However, wire transfers are a good option if you would prefer to see your money than have a bank write you a check. Your bank may allow wire transfers. You'll probably get your money in a few days depending on which bank you use.

Another option is a prepaid mortgage. These are very popular for people who want to sell their house and start afresh. A prepaid mortgage saves you time because you don't have to deal with a lender until you close on your new house.

While there is no guarantee you'll get your money when you sell your home, the majority of sellers will. Most residential real estate contracts allow the seller to keep some of their down payment as liquidated damages. This is usually a percentage of the sale price.

It can be frustrating to wait for a check that has not yet been cashed. Some banks prefer to hold large checks for a day or more. The seller might not receive the money as soon as they send paper checks. Except if you have a prepaid mortgage, you will have all of the necessary paperwork to get your money.

The details of each sale will determine the length of time it takes to pay the seller. Your state may have a dry funds system. This means you have to wait until you have satisfied all the requirements of your buyer before you can get the money. You might also have a system that allows you to get your money immediately. For instance, in the west coast, the time it takes to get a check after closing is typically only three days.

Selling your home can be expensive. The commission is the largest cost. A seller is typically paid 2.5 to 3% commission on the sale. The cost of title insurance, real estate agent fees, and other ancillary charges should all be considered. All fees add up to between 8-10% to your overall sales price.

FAQ

Should I use an mortgage broker?

A mortgage broker can help you find a rate that is competitive if it is important to you. Brokers have relationships with many lenders and can negotiate for your benefit. Brokers may receive commissions from lenders. Before signing up, you should verify all fees associated with the broker.

Is it possible to sell a house fast?

You may be able to sell your house quickly if you intend to move out of the current residence in the next few weeks. You should be aware of some things before you make this move. First, find a buyer for your house and then negotiate a contract. Second, prepare your property for sale. Third, your property must be advertised. Finally, you need to accept offers made to you.

What are the drawbacks of a fixed rate mortgage?

Fixed-rate mortgages have lower initial costs than adjustable rates. Additionally, if you decide not to sell your home by the end of the term you could lose a substantial amount due to the difference between your sale price and the outstanding balance.

Can I get a second mortgage?

Yes. However, it's best to speak with a professional before you decide whether to apply for one. A second mortgage is typically used to consolidate existing debts or to fund home improvements.

Is it cheaper to rent than to buy?

Renting is generally cheaper than buying a home. But, it's important to understand that you'll have to pay for additional expenses like utilities, repairs, and maintenance. There are many benefits to buying a home. You will have greater control of your living arrangements.

Statistics

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

External Links

How To

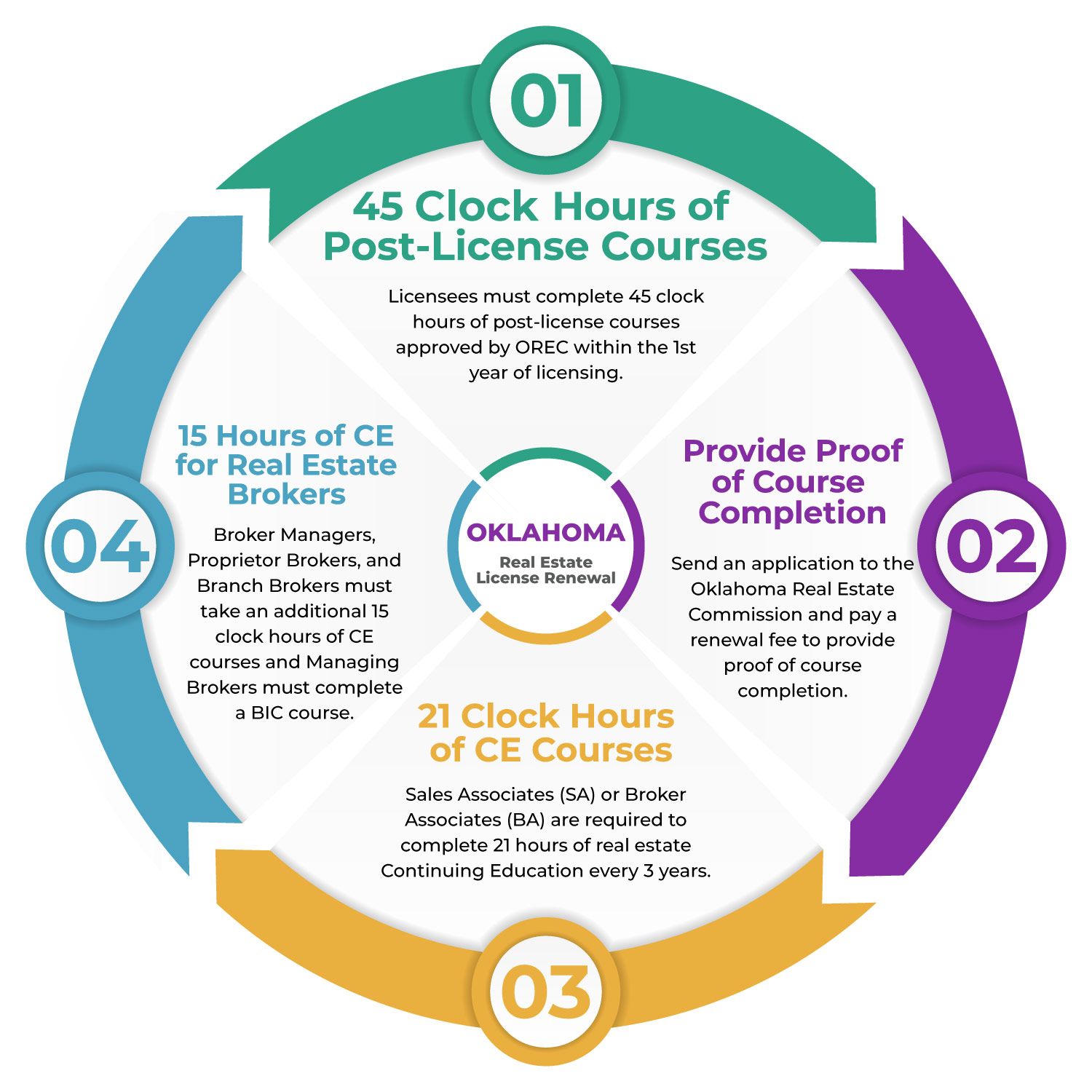

How to become real estate broker

The first step in becoming a real estate agent is to attend an introductory course where you learn everything there is to know about the industry.

Next you must pass a qualifying exam to test your knowledge. This requires you to study for at least two hours per day for a period of three months.

This is the last step before you can take your final exam. You must score at least 80% in order to qualify as a real estate agent.

Once you have passed these tests, you are qualified to become a real estate agent.