You need a real license if you plan to become a Tennessee-based real estate agent. You will need to complete 60 hours worth of coursework. This includes a 30-hour course that is specifically for new affiliates. After completing this course, the exam can be taken.

Education

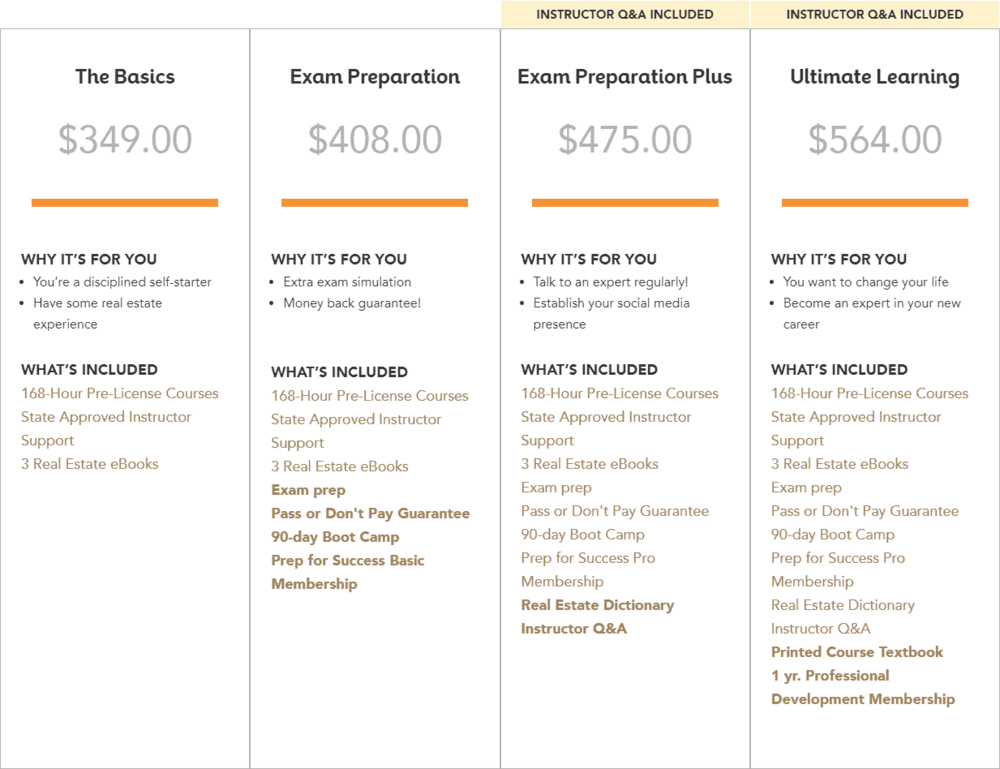

Several online schools offer pre-license education courses. Many of these schools offer self-paced learning and study materials. Some even offer a guarantee that you will pass the exam the first and last time. You should choose the course that best meets your needs and your learning style. Some provide test prep and instructor support.

In Tennessee, there are several approved real estate schools. Some schools offer online training, while others provide both in-person and online classes. You should find one that meets your learning needs and budget. Colibri Real Estate, for example, offers affordable packages that include coaching and exam prep. The company has helped hundreds of thousands of new agents obtain their license. They also offer a 25% discount on their courses, making it even more affordable.

Experience

Getting a real estate license in Tennessee is a complicated process, especially for newbies. It will require you to pass a strict pre-licensing procedure, complete background checks, and be familiar with the Tennessee laws and regulations. You have a guide to help make your transition easier. You should find a brokerage offering training for newly licensed agents. It should provide a formal program of training and mentoring. These people should be accessible to assist you outside of business hours.

It is essential that you determine how much you are likely to earn before you consider getting a Tennessee realty license. A commission of 2.75% means that you will earn $11,500 per home. That's $105K per year if you sell ten homes per month. You will need to have enough savings to start your own business in this highly competitive market. If you want to make a living, experience is important.

Exam

If you are ready to get started as a real estate agent in Tennessee, you will first need to pass the state real estate licensing exam. You must bring the required form of identification and fingerprints in order to take the exam. The testing company will use these to run a background check. This background check will also include information about any criminal records you may have.

Many resources are available online to help prepare you for the exam. If you have been looking for a quality exam prep program, you can try PSI Exams. They offer top-quality preparation and a 100% money-back guarantee.

Renewing your license

When it comes to renewing your real estate license, there are a few steps you need to take to ensure that you meet the deadlines. You must ensure that your continuing education requirements are met. You must take a course of three hours covering fair housing laws in both the national and state levels. This course must be completed in the two-year period before your license expires.

A second step is to verify the correct information on your renewal form. By reviewing the form with your broker, you can verify it. Your broker must also certify your application, if you renew online through DRE's licensing platform. Check the status and renew your license after you have submitted your request.

FAQ

How do I know if my house is worth selling?

Your home may not be priced correctly if your asking price is too low. If you have an asking price well below market value, then there may not be enough interest in your home. Get our free Home Value Report and learn more about the market.

What are the benefits of a fixed-rate mortgage?

Fixed-rate mortgages guarantee that the interest rate will remain the same for the duration of the loan. This will ensure that there are no rising interest rates. Fixed-rate loans come with lower payments as they are locked in for a specified term.

How many times may I refinance my home mortgage?

It all depends on whether your mortgage broker or another lender is involved in the refinance. You can refinance in either of these cases once every five-year.

How long does it usually take to get your mortgage approved?

It is dependent on many factors, such as your credit score and income level. It typically takes 30 days for a mortgage to be approved.

Do I need flood insurance?

Flood Insurance protects from flood-related damage. Flood insurance protects your possessions and your mortgage payments. Find out more information on flood insurance.

Can I purchase a house with no down payment?

Yes! Yes. There are programs that will allow those with small cash reserves to purchase a home. These programs include conventional mortgages, VA loans, USDA loans and government-backed loans (FHA), VA loan, USDA loans, as well as conventional loans. For more information, visit our website.

What are the cons of a fixed-rate mortgage

Fixed-rate loans are more expensive than adjustable-rate mortgages because they have higher initial costs. A steep loss could also occur if you sell your home before the term ends due to the difference in the sale price and outstanding balance.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

How to Find Houses To Rent

For people looking to move, finding houses to rent is a common task. It can be difficult to find the right home. When you are looking for a home, many factors will affect your decision-making process. These factors include the location, size, number and amenities of the rooms, as well as price range.

It is important to start searching for properties early in order to get the best deal. Also, ask your friends, family, landlords, real-estate agents, and property mangers for recommendations. This will allow you to have many choices.